A Novel Approach

We have no interest in “flipping” your company. We are focused on the long-term and define success as creating value for customers, employees, stakeholders and our community. In order to do so we will formulate a growth strategy for the business and invest additional capital in attractive growth opportunities and necessary infrastructure improvements required to advance your business. Our number one priority is the continued success of your business. In the short term this means we will invest the time and energy required to truly understand your business. We value continuity of company culture, stable employee relations and strong community standing.

We have no interest in “flipping” your company. We are focused on the long-term and define success as creating value for customers, employees, stakeholders and our community. In order to do so we will formulate a growth strategy for the business and invest additional capital in attractive growth opportunities and necessary infrastructure improvements required to advance your business. Our number one priority is the continued success of your business. In the short term this means we will invest the time and energy required to truly understand your business. We value continuity of company culture, stable employee relations and strong community standing.

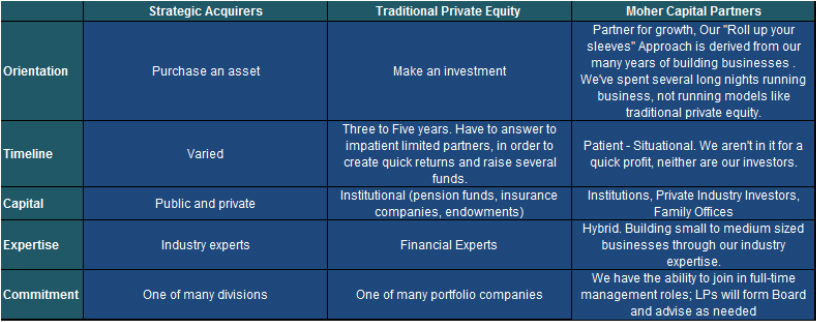

We provide an alternative for business owners looking to transition from day-to-day operating responsibility or bring on additional day-to-day managers and board members to help accelerate company growth. We are unlike strategic acquirers and traditional private equity investors in the following important ways:

Our Process

As entrepreneurs ourselves, we recognize that selling a business is an emotional process. Successful businesses represent the product of years, often decades, of hard work. Our experience acquiring and operating businesses allows us to anticipate and address issues early in the process, enabling us to facilitate a smooth transition. We understand that a long, drawn out sale process puts significant stress on employees and the organization. We have capital ready to deploy in the right opportunity and will work diligently to complete a transaction within the timeframe and terms originally agreed upon.

We are not interested in distressed situations. Rather, we are interested in acquiring a business at a fair market value that represents the company’s history of success and potential for growth. Our partnership structure provides us with flexibility to tailor a transaction to meet your needs with regard to estate planning, tax issues and family members who may want to remain involved in the business. We support owners continued involvement in the business at whatever level is desired.

Post Closing

Depending on the situation and need, we have the ability to deploy resources to run the day to day operations. The specific roles will be determined based on the ongoing needs of the business. In addition, a select group of our Limited Partners will form the core of a board of directors to help guide the company going forward. Those Limited Partners who do not assume board positions will provide advice and guidance in their respective areas of expertise on an as needed basis. Our Advisory Board is a critical success factor in serving on portfolio company boards and working closely with management teams to lend their industry, strategic, operational and situational expertise. When pursuing an investment opportunity we have a deep bench of industry professionals we repeatedly partner with in order to help augment our knowledge base as well as assist with strategy on a go forward basis. We believe that the key to driving successful growth is through bringing best practices and experiences that compliment the current management team to the table.

As entrepreneurs ourselves, we recognize that selling a business is an emotional process. Successful businesses represent the product of years, often decades, of hard work. Our experience acquiring and operating businesses allows us to anticipate and address issues early in the process, enabling us to facilitate a smooth transition. We understand that a long, drawn out sale process puts significant stress on employees and the organization. We have capital ready to deploy in the right opportunity and will work diligently to complete a transaction within the timeframe and terms originally agreed upon.

We are not interested in distressed situations. Rather, we are interested in acquiring a business at a fair market value that represents the company’s history of success and potential for growth. Our partnership structure provides us with flexibility to tailor a transaction to meet your needs with regard to estate planning, tax issues and family members who may want to remain involved in the business. We support owners continued involvement in the business at whatever level is desired.

Post Closing

Depending on the situation and need, we have the ability to deploy resources to run the day to day operations. The specific roles will be determined based on the ongoing needs of the business. In addition, a select group of our Limited Partners will form the core of a board of directors to help guide the company going forward. Those Limited Partners who do not assume board positions will provide advice and guidance in their respective areas of expertise on an as needed basis. Our Advisory Board is a critical success factor in serving on portfolio company boards and working closely with management teams to lend their industry, strategic, operational and situational expertise. When pursuing an investment opportunity we have a deep bench of industry professionals we repeatedly partner with in order to help augment our knowledge base as well as assist with strategy on a go forward basis. We believe that the key to driving successful growth is through bringing best practices and experiences that compliment the current management team to the table.